The latest Case-Shiller Index was published on Tuesday, April 29th 2014. As always, the index reports on data 60 days in arrears. Therefore, the index reports Metro Atlanta home values for February 2013. So what does the latest index show and what does that mean for home values in Metro Atlanta? Home values have significantly improved and are now stabilizing. To properly assess the Case-Shiller Index data, two important considerations must be taken into account. First, the Case-Shiller index of home values is very different from average sale prices or median homes prices. The Case-Shiller Index reports on repeat properties sold, which are generally better indicators of home values. Second, this index reflects average home values for all of Metro Atlanta. Remember, real estate is local and every market is different. Your local BHHS Georgia Properties agent can help you understand the specific metrics in your local market.

Now for the news…. Average home prices for the National 20-City Index remained relatively unchanged compared to last month and increased 12.9% over the same month a year ago. While these numbers remain very positive, we must bear in mind that home prices are still down 17.49% from the peak of July 2007. The February index for Atlanta is 112.60. This is the fifth month in a row that the index has reported a small decrease. This signals that home values are leveling off for many markets. Las Vegas, San Diego, Los Angeles and San Francisco continue to have the highest year-over-year price increases. These were closely followed by Atlanta, Miami, Detroit and Phoenix. New York, Cleveland and Charlotte showed the smallest year-over-year improvements.

The Metro Atlanta real estate market continues to show signs of moving back to a normal market. Listing inventory is up 23.9% from the bottom of February 2013. Inventory is up 6.8% from last month and up 18.9% from the same month last year. Closings were up 17.8% from last month and down 12.4% from the same month last year. Months of inventory are now 4.7 months based upon the latest closed sales trend. Six months supply is considered normal. Buyer activity remains strong led by baby boomers and first-time buyers. At the same time, the pace of pre-foreclosures (notices of default) and foreclosures has slowed dramatically. Resales and new homes are outpacing bank-owned sales. New Homes are making a significant comeback. Right now there is very low new homes inventory due to the high absorption and pre-sales are emerging again. In the next few years, new homes will become a more significant part of the inventory and closed sales. Your local Berkshire Hathaway HomeServices Georgia Properties agent can show you the specific conditions in your market so you can make the best real estate decisions.

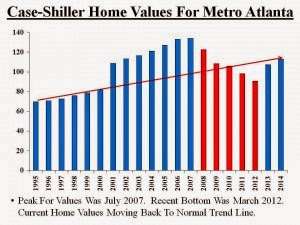

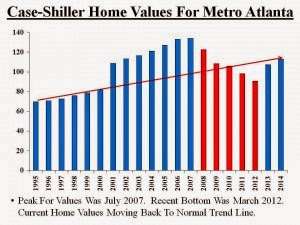

What a change from a few years ago! Metro Atlanta Home Values are up 37% from the most recent low point of February 2012 according to the Case-Shiller Index. But remain down 17.49% from the peak of July 2007. View the graph of the monthly Case-Shiller results from 2010, 2011, 2012, 2013 and 2014.

If you look back further at home values (see chart below), you can see that we had a bubble in homes values. As with many cyclical markets, we over-corrected with values that were well below the normal patterns. Now, we appear to be back on the normal trend line!

This chart shows the “months supply” based upon price ranges. As you can see, the supply is very low in the lower price ranges. Investors have been very active in these price ranges but that has slowed considerably. As you get to the luxury market, there is more supply available based on the slower rate of closed sales. Contact your local Berkshire Hathaway HomeServices Georgia Properties agent to see the latest trends in your specific area.

If you look at the average annual Case-Shiller index for each year, here is how homes purchased in recent years would compare to the current index:

Homes Bought in 2000 – Gain 9.08%

Homes Bought in 2001 – Gain of 3.29%

Homes Bought in 2002 – Gain of .54%

Homes Bought in 2003 – Loss of 3.67%

Homes Bought in 2004 – Loss of 6.95%

Homes Bought in 2005 – Loss of 11.42%

Homes Bought in 2006 – Loss of 15.46%

Homes Bought in 2007 – Loss of 16.00%

Homes Bought in 2008 – Loss of 8.19%

Homes Bought in 2009 – Gain of 3.87%

Homes Bought in 2010 – Gain of 6.46%

Homes Bought in 2011 – Gain of 14.48%

Homes Bought in 2012 – Gain of 24.12%

Yes, we are slowly climbing our way out of this unprecedented housing crisis. So where will home values go from here? The key factors that will impact our home values include the following:

Demand from Buyers: The long-term trend for buyer demand is strong as buyers take advantage while prices remain below replacement costs and mortgage financing is historically low. We continue to see significant pent-up demand for new household formation from first time buyers and a very active baby boomer market. The economic indicators remain very positive with the exception of household disposable income remaining flat. We will be watching the buyer trends closely this spring to determine of we have any changes in the leading indicators.

Mortgage Rates/ Credit Availability: Average mortgage rates in the past 50 years were 8%. Rates remain historically low but the long-term trend is higher. Freddie Mac and the Mortgage Bankers Association predict mortgage rates to rise to over 5% in 2014 and 6% in 2015. Barring any major geo-political issues that impact or economy or fuel inflation, we expect to see rates in the 6-8% range again in 3-5 years.

Supply/ Inventory Levels: The inventory has been rising over the past few months as we move toward a more normal level of supply. New homes will become a more significant part of the overall inventory by the spring. Every market is different and we have some local markets where desirable inventory remains very low.

Competition from Short Sales/ Foreclosures: In 2010, RealValuator reports that short sales and foreclosures were over 60% of the transactions sold but have dropped to only a few hundred transactions per month in 2014. Resales and new homes are significantly outpacing short sales and bank-owned properties.

New Homes Make A Comeback: New Home starts are rising and will slowly but surely become a major factor for Metro Atlanta real estate. In 3-5 years, we expect New Homes to return to 40%-45% of the inventory and closed sales. For resale owners, your competition will shift from foreclosures & short sales to new homes. But there is a silver lining since the costs of building is going up. Higher new home prices may also help bring up values for resales.

It is clear that the housing market for the Greater Metro Atlanta area is improving. Right now, we still have prices below replacement costs and incredible mortgage rates. But the trends for mortgage rates are upward. Many buyers and sellers need to act quickly before their buying power is impacted significantly. In 5 or 10 years, many will look back and regret not buying their dream home when they had the chance! The cost of waiting could be quite significant. Check back for our next posts with the latest facts and insight that can make you money!

Labels: 2014, Alpharetta, Atlanta Case-Shiller April 2014, Cumming, home values, milton

# posted by

Brian Vanderhoff @ 11:03 AM